Crypto as a Mainstream Payment Method: Progress and Prospects

- The Rise of Cryptocurrency in Everyday Transactions

- Exploring the Evolution of Crypto as a Payment Method

- Challenges and Opportunities for Cryptocurrency Adoption

- The Future of Digital Currency in Retail and E-commerce

- Cryptocurrency Integration in Traditional Payment Systems

- Consumer Perspectives on Using Crypto for Purchases

The Rise of Cryptocurrency in Everyday Transactions

As the popularity of cryptocurrency continues to grow, more and more businesses are starting to accept digital currencies as a form of payment. This rise of cryptocurrency in everyday transactions is changing the way people think about money and how they make purchases.

One of the main reasons for the increasing acceptance of cryptocurrency is the security and privacy it offers. Transactions made with cryptocurrencies are encrypted and secure, making them less vulnerable to fraud and identity theft. This added layer of security is appealing to both consumers and businesses alike.

Another factor driving the rise of cryptocurrency in everyday transactions is the speed and convenience it offers. With traditional payment methods, transactions can take days to process, especially for international payments. Cryptocurrency transactions, on the other hand, can be completed in a matter of minutes, making them ideal for fast-paced modern life.

Furthermore, the decentralized nature of cryptocurrencies means that they are not subject to the same regulations and fees as traditional banking systems. This can result in lower transaction costs for businesses, which can then be passed on to consumers in the form of lower prices.

Overall, the rise of cryptocurrency in everyday transactions represents a significant shift in the way we think about money and how we conduct financial transactions. As more businesses and consumers embrace digital currencies, the use of cryptocurrency as a mainstream payment method is likely to continue to grow in the coming years.

Exploring the Evolution of Crypto as a Payment Method

The evolution of cryptocurrency as a payment method has been a fascinating journey to witness. Initially starting as a niche form of digital currency used by tech enthusiasts and early adopters, crypto has now made significant strides towards mainstream acceptance.

One of the key factors driving this evolution is the increasing number of merchants and businesses that are now accepting cryptocurrency as a form of payment. From small online retailers to major corporations, the acceptance of crypto has grown exponentially in recent years. This trend is not only a testament to the growing popularity of cryptocurrency but also to its potential as a viable alternative to traditional payment methods.

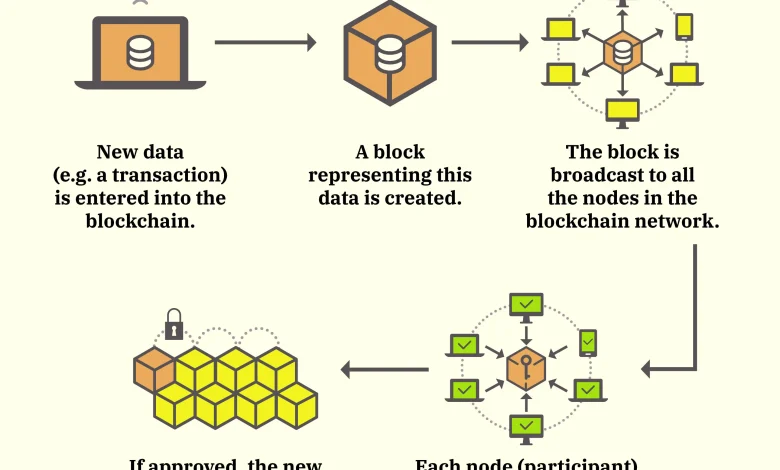

Another important development in the evolution of crypto as a payment method is the improvement in transaction speed and security. With advancements in blockchain technology, transactions can now be processed faster and with greater security than ever before. This has helped to address some of the concerns that consumers and businesses may have had about using cryptocurrency for transactions.

Furthermore, the integration of cryptocurrency into existing payment systems has also played a significant role in its evolution. With the development of platforms and services that allow for seamless integration of crypto payments, more businesses are now able to offer this option to their customers. This has helped to bridge the gap between traditional payment methods and cryptocurrency, making it easier for people to use crypto in their everyday transactions.

Overall, the evolution of cryptocurrency as a payment method has been a gradual but steady process. With increasing acceptance, improved technology, and better integration into existing systems, crypto is well on its way to becoming a mainstream payment method. As more people become familiar with and comfortable using cryptocurrency, its adoption is likely to continue to grow in the years to come.

Challenges and Opportunities for Cryptocurrency Adoption

There are several challenges and opportunities for the adoption of cryptocurrency as a mainstream payment method. One of the main challenges is the lack of widespread understanding and acceptance of cryptocurrencies among the general population. Many people are still unfamiliar with how cryptocurrencies work and are hesitant to use them for transactions.

Another challenge is the regulatory environment surrounding cryptocurrencies. Governments around the world are still figuring out how to regulate this new form of digital currency, which can create uncertainty for businesses and consumers alike. Additionally, the volatility of cryptocurrency prices can make it risky for merchants to accept them as payment.

Despite these challenges, there are also many opportunities for cryptocurrency adoption. One of the main opportunities is the growing interest in blockchain technology, which underpins cryptocurrencies. Blockchain has the potential to revolutionize the way transactions are conducted, making them faster, more secure, and more transparent.

Another opportunity is the increasing number of businesses that are starting to accept cryptocurrencies as payment. This trend is driven by the lower transaction fees associated with cryptocurrencies compared to traditional payment methods, as well as the potential for increased security and privacy.

In conclusion, while there are challenges to overcome, the opportunities for cryptocurrency adoption as a mainstream payment method are significant. As more people become familiar with cryptocurrencies and as the regulatory environment becomes more clear, we are likely to see continued growth in the use of cryptocurrencies for everyday transactions.

The Future of Digital Currency in Retail and E-commerce

The future of digital currency in retail and e-commerce is promising, with more businesses starting to accept cryptocurrencies as a mainstream payment method. This shift towards embracing crypto is driven by the growing demand from consumers who are looking for more convenient and secure ways to make purchases online. As technology continues to advance, the use of digital currencies in retail transactions is expected to become even more widespread.

One of the key advantages of using cryptocurrencies in retail and e-commerce is the lower transaction fees compared to traditional payment methods. This cost-effectiveness can benefit both businesses and consumers, making it an attractive option for all parties involved. Additionally, the decentralized nature of cryptocurrencies provides a level of security and privacy that is not always guaranteed with traditional payment systems.

As more retailers and e-commerce platforms adopt digital currencies, consumers will have greater flexibility in how they choose to pay for goods and services. This increased acceptance of crypto as a mainstream payment method will likely lead to a more seamless shopping experience for customers, ultimately driving more sales for businesses. With the rise of digital wallets and mobile payment apps, the integration of cryptocurrencies into retail and e-commerce is becoming more convenient and accessible than ever before.

Overall, the future of digital currency in retail and e-commerce looks bright, with the potential to revolutionize the way we make transactions online. As businesses continue to adapt to the changing landscape of digital payments, consumers can expect to see more options for using cryptocurrencies in their everyday shopping experiences. This shift towards mainstream acceptance of crypto as a payment method is a positive development that is poised to benefit both businesses and consumers alike.

Cryptocurrency Integration in Traditional Payment Systems

Cryptocurrency integration in traditional payment systems has been a topic of interest for many in the financial industry. The idea of using digital currencies for everyday transactions is gaining traction as more businesses and consumers see the benefits of this alternative payment method.

One of the main advantages of integrating cryptocurrencies into traditional payment systems is the increased security and privacy they offer. Transactions made with cryptocurrencies are encrypted and decentralized, making them less vulnerable to fraud and identity theft. This added layer of security is appealing to both merchants and customers who want to protect their financial information.

Another benefit of cryptocurrency integration is the lower transaction fees associated with digital currencies. Traditional payment systems often charge high fees for processing transactions, especially for international payments. Cryptocurrencies, on the other hand, have lower fees and faster processing times, making them a more cost-effective option for businesses and consumers alike.

Furthermore, the use of cryptocurrencies in traditional payment systems can help to streamline the payment process and reduce the need for intermediaries. This can lead to faster transactions and greater efficiency in the overall payment system. Additionally, the use of cryptocurrencies can help to expand access to financial services for those who are underserved by traditional banking systems.

Overall, the integration of cryptocurrencies into traditional payment systems has the potential to revolutionize the way we think about money and transactions. As more businesses and consumers adopt digital currencies, we can expect to see continued growth and innovation in this space.

Consumer Perspectives on Using Crypto for Purchases

Consumer perspectives on using cryptocurrency for purchases vary widely. Some individuals view it as a convenient and secure payment method that offers anonymity and decentralization. Others are skeptical due to concerns about price volatility, regulatory uncertainty, and the potential for fraud.

Despite these mixed views, there is a growing trend towards mainstream adoption of crypto as a payment method. More businesses are starting to accept digital currencies, and payment processors are integrating crypto into their platforms. This shift is driven by the increasing demand from tech-savvy consumers who value the speed and efficiency of crypto transactions.

One of the main advantages of using cryptocurrency for purchases is the low transaction fees compared to traditional payment methods. This cost-effectiveness is particularly appealing to merchants, who can save money on processing fees and chargebacks. Additionally, crypto transactions are irreversible, reducing the risk of fraud for both buyers and sellers.

However, there are still challenges that need to be addressed before crypto can become a mainstream payment method. These include scalability issues, regulatory compliance, and the need for user-friendly interfaces. Overcoming these obstacles will be crucial for crypto to gain wider acceptance among consumers and businesses alike.