Blockchain Solutions in the Insurance Industry

- Understanding Blockchain Technology

- Challenges Faced by the Insurance Industry

- Benefits of Implementing Blockchain Solutions

- Use Cases of Blockchain in Insurance

- Regulatory Considerations for Blockchain Adoption

- Future Trends in Blockchain Technology for Insurance

Understanding Blockchain Technology

Blockchain technology is a decentralized, distributed ledger system that allows for secure and transparent transactions. It operates on a peer-to-peer network, eliminating the need for intermediaries and reducing the risk of fraud. In the insurance industry, blockchain solutions offer a way to streamline processes, improve data security, and enhance customer trust.

One of the key features of blockchain technology is its ability to create a tamper-proof record of transactions. Each block in the chain contains a timestamp and a link to the previous block, making it nearly impossible to alter or delete information. This level of transparency and immutability can help insurance companies verify the authenticity of claims, prevent fraudulent activities, and ensure compliance with regulations.

By leveraging blockchain technology, insurance companies can also improve the efficiency of their operations. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate claims processing, policy issuance, and premium payments. This not only reduces the time and costs associated with manual processes but also minimizes the potential for errors and disputes.

Furthermore, blockchain solutions can enhance data security in the insurance industry. With traditional databases, sensitive information is stored in centralized servers that are vulnerable to cyber attacks. In contrast, blockchain technology encrypts data and distributes it across multiple nodes, making it more resistant to hacking and unauthorized access. This can help protect customer data, prevent identity theft, and ensure compliance with data protection laws.

Overall, blockchain technology has the potential to revolutionize the insurance industry by providing a more efficient, secure, and transparent way of conducting business. By embracing blockchain solutions, insurance companies can streamline processes, reduce costs, and build trust with their customers. As the technology continues to evolve, it will be interesting to see how it shapes the future of the insurance industry.

Challenges Faced by the Insurance Industry

The insurance industry faces several challenges that can be addressed through the implementation of blockchain solutions. These challenges include:

- Lack of transparency: Traditional insurance processes can be opaque, leading to a lack of trust between insurers and policyholders.

- Data security concerns: With sensitive personal and financial information being exchanged, data security is a top priority for the insurance industry.

- Slow and inefficient claims processing: The current claims process can be time-consuming and prone to errors, leading to delays in payouts.

- Fraud prevention: Insurance fraud is a significant issue that costs the industry billions of dollars each year.

- High administrative costs: The administrative overhead of managing policies, claims, and other processes can be a significant burden on insurers.

By leveraging blockchain technology, the insurance industry can overcome these challenges and streamline operations for both insurers and policyholders. Blockchain offers a secure, transparent, and efficient way to store and transfer data, reducing the risk of fraud and improving the speed and accuracy of claims processing. With blockchain solutions, insurers can lower administrative costs and build trust with their customers, ultimately leading to a more sustainable and profitable industry.

Benefits of Implementing Blockchain Solutions

Implementing blockchain solutions in the insurance industry offers a wide range of benefits that can revolutionize the way insurance companies operate and interact with their customers. Some of the key advantages of utilizing blockchain technology in the insurance sector include:

- **Enhanced Security:** Blockchain technology provides a secure and tamper-proof way of storing and sharing data, reducing the risk of fraud and unauthorized access.

- **Increased Transparency:** The decentralized nature of blockchain allows for transparent and verifiable transactions, which can help build trust between insurers and policyholders.

- **Efficient Claims Processing:** By automating and streamlining the claims process through smart contracts, blockchain can significantly reduce the time and costs associated with claims processing.

- **Improved Data Management:** Blockchain enables insurers to securely store and manage large amounts of data, leading to more accurate risk assessments and personalized insurance products.

- **Fraud Prevention:** The immutability of blockchain records makes it easier to detect and prevent fraudulent activities, ultimately saving insurers money and protecting policyholders.

In conclusion, the implementation of blockchain solutions in the insurance industry can bring about a myriad of benefits that can transform the way insurance companies operate and deliver services to their customers. By leveraging the security, transparency, efficiency, and fraud prevention capabilities of blockchain technology, insurers can stay ahead of the curve and provide better experiences for both policyholders and stakeholders.

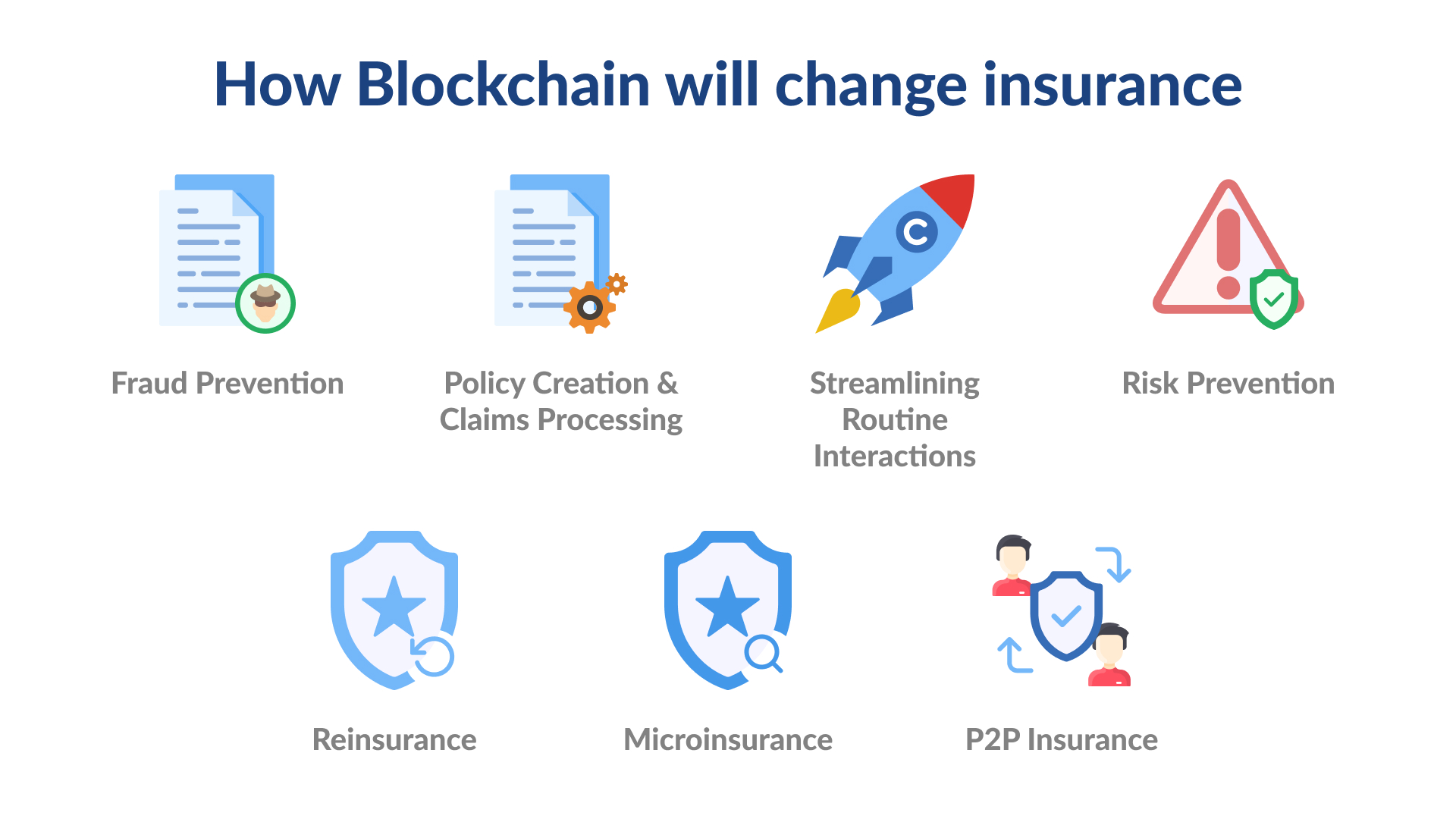

Use Cases of Blockchain in Insurance

Blockchain technology has the potential to revolutionize the insurance industry by improving transparency, security, and efficiency. There are several use cases of blockchain in insurance that can benefit both insurers and policyholders:

- **Claims Processing:** One of the most significant applications of blockchain in insurance is streamlining the claims process. By using smart contracts, claims can be automatically verified and processed, reducing the time and costs associated with manual processing.

- **Fraud Prevention:** Blockchain can help prevent fraud in the insurance industry by creating a secure and immutable record of all transactions. This can help detect any suspicious activity and prevent fraudulent claims from being paid out.

- **Data Security:** With blockchain, sensitive customer data can be stored securely and accessed only by authorized parties. This can help prevent data breaches and protect customer privacy.

- **Policy Management:** Blockchain can simplify policy management by providing a transparent and tamper-proof record of all policy details. This can help ensure that all parties have access to the most up-to-date information.

- **Reinsurance:** Blockchain can also be used in reinsurance to improve transparency and streamline the process of transferring risk between insurers. This can help reduce disputes and delays in the reinsurance process.

Overall, blockchain technology has the potential to transform the insurance industry by making processes more efficient, secure, and transparent. By leveraging blockchain solutions, insurers can improve customer trust, reduce costs, and enhance overall operational efficiency.

Regulatory Considerations for Blockchain Adoption

When considering the adoption of blockchain solutions in the insurance industry, it is crucial to take into account the regulatory landscape that governs this technology. Regulations play a significant role in shaping how blockchain can be utilized within the insurance sector, ensuring compliance with legal requirements and protecting the interests of all stakeholders involved.

One of the key regulatory considerations for blockchain adoption in insurance is data privacy and security. As blockchain technology involves the storage and sharing of sensitive information across a distributed network, it is essential to adhere to data protection regulations such as the General Data Protection Regulation (GDPR). Compliance with these regulations is necessary to safeguard customer data and maintain trust in the insurance industry.

Another important aspect to consider is the validation of transactions on the blockchain. Regulatory bodies may require insurance companies to implement mechanisms that verify the authenticity and integrity of transactions recorded on the blockchain. This ensures transparency and accountability, reducing the risk of fraud and ensuring compliance with regulatory standards.

Furthermore, smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, raise legal considerations in the insurance industry. Regulatory frameworks need to evolve to accommodate the use of smart contracts, ensuring that they are legally enforceable and comply with existing laws and regulations.

In conclusion, regulatory considerations are a critical factor in the adoption of blockchain solutions in the insurance industry. By addressing data privacy, transaction validation, and legal implications of smart contracts, insurance companies can navigate the regulatory landscape effectively and leverage the benefits of blockchain technology to enhance efficiency, transparency, and security in their operations.

Future Trends in Blockchain Technology for Insurance

As blockchain technology continues to evolve, the insurance industry is poised to benefit from several future trends. These trends are expected to revolutionize the way insurance companies operate and interact with their customers. Some of the key future trends in blockchain technology for insurance include:

- Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller directly written into lines of code. This technology can automate claims processing, policy management, and premium payments, reducing the need for intermediaries and streamlining the insurance process.

- Decentralized Insurance Platforms: Decentralized insurance platforms powered by blockchain technology are on the rise. These platforms allow for peer-to-peer insurance, where individuals can create and participate in insurance programs without the need for traditional insurance companies. This can lead to lower costs and more personalized insurance products.

- Data Security and Privacy: Blockchain technology offers enhanced security and privacy features that can help protect sensitive customer data. By storing data in a decentralized and encrypted manner, blockchain can reduce the risk of data breaches and unauthorized access, increasing trust between insurers and policyholders.

- Fraud Prevention: Blockchain’s transparent and immutable nature makes it an ideal tool for preventing insurance fraud. By recording all transactions on a shared ledger that cannot be altered, insurers can easily detect fraudulent activities and take action to mitigate risks.

- Parametric Insurance: Parametric insurance is a type of insurance that pays out when predefined conditions are met, rather than based on actual losses incurred. Blockchain technology can automate the triggering and payout process for parametric insurance, making it more efficient and cost-effective for both insurers and policyholders.

Overall, the future of blockchain technology in the insurance industry looks promising, with the potential to drive innovation, improve efficiency, and enhance customer experience. Insurers that embrace these trends and incorporate blockchain solutions into their operations stand to gain a competitive edge in the evolving insurance landscape.