Analyzing Seasonal Trends in Cryptocurrency Markets

- Understanding the impact of seasonal trends on cryptocurrency prices

- Exploring the historical patterns of price fluctuations in cryptocurrency markets

- How seasonal factors influence investor behavior in the crypto space

- Analyzing the correlation between market trends and seasonal events in cryptocurrencies

- Strategies for navigating the volatile nature of seasonal trends in crypto markets

- Predicting future price movements based on past seasonal trends in cryptocurrencies

Understanding the impact of seasonal trends on cryptocurrency prices

Understanding the impact of seasonal trends on cryptocurrency prices is crucial for investors looking to make informed decisions in the market. Just like traditional financial markets, the cryptocurrency market experiences fluctuations throughout the year that can be attributed to various factors.

One of the key seasonal trends that affect cryptocurrency prices is the holiday season. During holidays, trading volumes tend to decrease as investors take time off, leading to lower liquidity in the market. This lower liquidity can result in increased price volatility, making it important for investors to be aware of these trends.

Another seasonal trend that impacts cryptocurrency prices is the tax season. As tax deadlines approach, investors may sell off their holdings to cover tax liabilities, putting downward pressure on prices. Understanding these trends can help investors anticipate market movements and adjust their strategies accordingly.

Additionally, factors such as regulatory announcements, technological developments, and macroeconomic trends can also influence cryptocurrency prices throughout the year. By analyzing seasonal trends and staying informed about market dynamics, investors can better navigate the volatile cryptocurrency market and make more informed investment decisions.

Exploring the historical patterns of price fluctuations in cryptocurrency markets

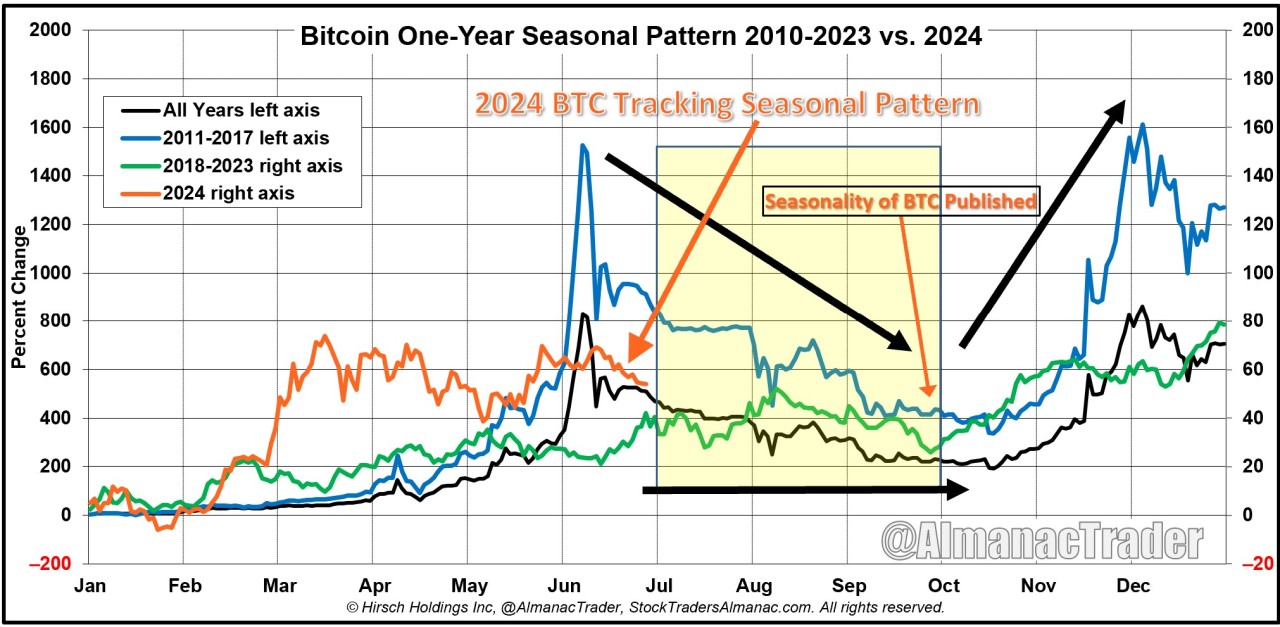

Cryptocurrency markets have shown interesting historical patterns of price fluctuations over time. By analyzing these trends, we can gain valuable insights into the behavior of digital assets and potentially predict future movements. One common approach is to explore seasonal trends, which refer to recurring patterns that occur at specific times of the year.

**Historical data** reveals that cryptocurrency prices tend to exhibit certain trends during different seasons. For example, there may be a tendency for prices to rise during the summer months and fall during the winter months. This could be due to various factors such as market sentiment, regulatory developments, or even external events like holidays.

**Analyzing these patterns** can help traders and investors make more informed decisions about when to buy or sell their assets. By understanding the historical price fluctuations, they can better anticipate market movements and adjust their strategies accordingly. This can potentially lead to higher profits and reduced risks in the volatile cryptocurrency market.

**It is important** to note that while seasonal trends can provide valuable insights, they should not be the sole basis for making investment decisions. Other factors such as technical analysis, market news, and overall market sentiment should also be taken into consideration. By combining different sources of information, traders can develop a more comprehensive understanding of the market and make more informed decisions.

How seasonal factors influence investor behavior in the crypto space

Investors in the cryptocurrency space are often influenced by seasonal factors that can impact their behavior and decision-making processes. Understanding how these seasonal trends affect the market can provide valuable insights for traders looking to capitalize on opportunities.

One key seasonal factor that influences investor behavior in the crypto space is the holiday season. During holidays, there is typically a decrease in trading volume as investors take time off to celebrate with their families. This can lead to increased volatility in the market as fewer trades are being made, causing prices to fluctuate more dramatically.

Another seasonal trend that affects investor behavior is the tax season. As tax deadlines approach, investors may be more inclined to sell off their assets to cover any tax liabilities they may have. This can lead to a decrease in prices as selling pressure increases, creating opportunities for savvy investors to buy at lower prices.

Additionally, the changing of seasons can also impact investor sentiment in the crypto space. For example, during the summer months, there may be a decrease in trading activity as investors take vacations and spend less time monitoring the market. This can lead to lower liquidity and increased price volatility.

Overall, understanding how seasonal factors influence investor behavior in the crypto space can help traders anticipate market movements and make more informed decisions. By staying aware of these trends and adjusting their strategies accordingly, investors can position themselves for success in the ever-changing cryptocurrency markets.

Analyzing the correlation between market trends and seasonal events in cryptocurrencies

When analyzing the correlation between market trends and seasonal events in cryptocurrencies, it is essential to consider how external factors can impact the value of digital assets. Seasonal events such as holidays, regulatory changes, and global economic conditions can all play a role in shaping the market trends of cryptocurrencies.

For example, during the holiday season, there is typically an increase in consumer spending, which can lead to a rise in the value of certain cryptocurrencies. Additionally, regulatory changes, such as government crackdowns or new legislation, can cause fluctuations in the market as investors react to the news.

Global economic conditions, such as inflation or geopolitical tensions, can also have a significant impact on the value of cryptocurrencies. Investors may turn to digital assets as a hedge against traditional markets during times of uncertainty, leading to increased demand and higher prices.

By analyzing these seasonal trends and understanding how they correlate with market events, investors can make more informed decisions when trading cryptocurrencies. It is essential to stay informed about current events and market trends to anticipate potential price movements and mitigate risks in the volatile cryptocurrency market.

Strategies for navigating the volatile nature of seasonal trends in crypto markets

When it comes to navigating the unpredictable nature of seasonal trends in crypto markets, it is essential to have a solid strategy in place. Here are some effective strategies to help you navigate the volatile nature of these trends:

- Diversification: One of the most important strategies to mitigate risk in the face of seasonal trends is diversification. By spreading your investments across different cryptocurrencies, you can reduce the impact of any single asset’s performance on your overall portfolio.

- Stay Informed: Keeping up to date with the latest news and developments in the cryptocurrency space is crucial for making informed decisions. By staying informed, you can better anticipate and react to seasonal trends as they unfold.

- Utilize Technical Analysis: Technical analysis can be a valuable tool for predicting market movements based on historical price data. By analyzing charts and patterns, you can identify potential trends and make more informed trading decisions.

- Set Stop-Loss Orders: Setting stop-loss orders can help protect your investments from significant losses during periods of market volatility. By automatically selling a cryptocurrency if it reaches a certain price, you can limit your downside risk.

- Take Profits: It is essential to take profits when the market is in your favor. By setting profit targets and sticking to them, you can lock in gains and reduce the impact of potential downturns in the market.

By implementing these strategies and staying disciplined in your approach to navigating seasonal trends in crypto markets, you can better position yourself to capitalize on opportunities and mitigate risks in this dynamic and ever-changing market.

Predicting future price movements based on past seasonal trends in cryptocurrencies

Cryptocurrency investors often look to past seasonal trends to predict future price movements in the market. By analyzing historical data, traders can identify patterns that tend to repeat at certain times of the year. This information can be valuable in making informed decisions about when to buy or sell digital assets.

One common strategy is to observe how certain cryptocurrencies have performed during specific months or seasons in the past. For example, some coins may experience a surge in value during the summer months, while others may see a dip in price during the winter. By recognizing these trends, investors can adjust their trading strategies accordingly.

It is important to note that while past performance is not indicative of future results, seasonal trends can provide valuable insights into market behavior. By combining this information with other technical and fundamental analysis, traders can develop a more comprehensive understanding of the cryptocurrency market.

Overall, analyzing seasonal trends in cryptocurrency markets can be a useful tool for investors looking to make informed decisions about their trading activities. By studying historical data and identifying patterns, traders can gain a better understanding of market dynamics and potentially improve their overall investment performance.