Mining vs. Staking: Which is More Profitable?

- Understanding the basics of mining and staking in the world of cryptocurrency

- Comparing the risks and rewards of mining and staking for passive income

- Analyzing the upfront costs and ongoing expenses of mining versus staking

- Exploring the environmental impact of mining versus the energy efficiency of staking

- Examining the potential for scalability and long-term profitability in mining and staking

- Considering the security implications and decentralization factors of mining and staking

Understanding the basics of mining and staking in the world of cryptocurrency

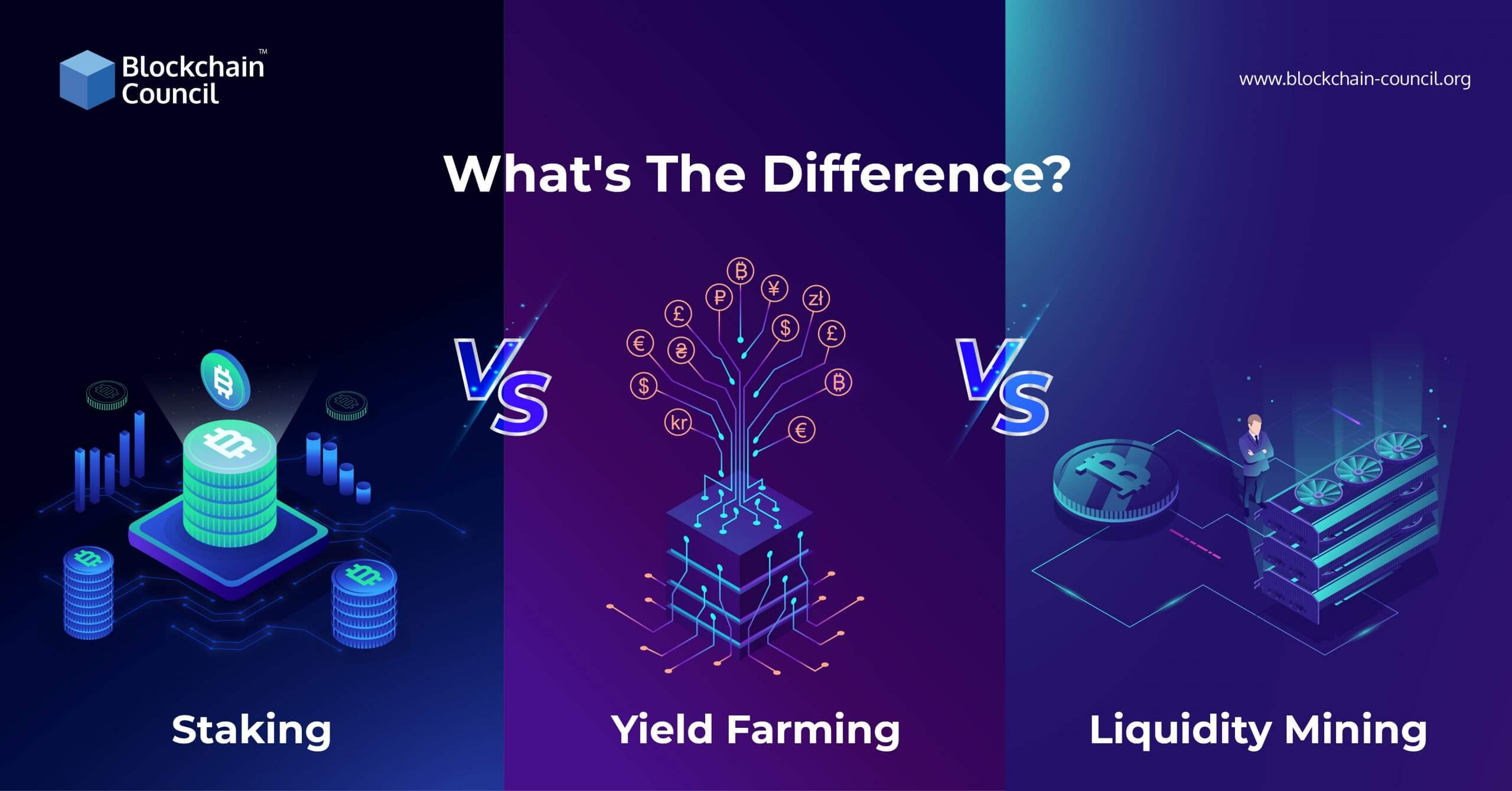

Mining and staking are two fundamental concepts in the world of cryptocurrency. Understanding the basics of these processes is crucial for anyone looking to get involved in the crypto space. Mining involves using computational power to solve complex mathematical problems that validate transactions on the blockchain. Miners are rewarded with newly minted coins for their efforts. On the other hand, staking involves participating in the proof-of-stake consensus mechanism by holding a certain amount of coins in a wallet. Stakers are chosen to validate transactions based on the number of coins they hold.

Comparing the risks and rewards of mining and staking for passive income

When comparing the risks and rewards of mining and staking for passive income, it is essential to consider various factors that can impact profitability. Both mining and staking have their advantages and disadvantages, and understanding these can help investors make informed decisions.

One of the main risks associated with mining is the high upfront costs involved in purchasing mining equipment and setting up the necessary infrastructure. Additionally, mining can be energy-intensive, leading to high electricity bills. On the other hand, staking requires less initial investment and is more energy-efficient, making it a more cost-effective option for some investors.

However, mining also has the potential for higher rewards compared to staking. Miners have the opportunity to earn block rewards and transaction fees, which can be lucrative if the price of the cryptocurrency being mined increases. Staking, on the other hand, offers more predictable returns but may not provide the same level of profitability as mining in a bull market.

Another factor to consider is the level of technical expertise required for mining and staking. Mining can be complex and requires knowledge of hardware and software, while staking is relatively straightforward and can be done by anyone with a stake in a particular cryptocurrency. This accessibility makes staking a more attractive option for novice investors.

In conclusion, both mining and staking have their own set of risks and rewards. While mining offers the potential for higher profits, it also comes with higher costs and technical requirements. Staking, on the other hand, is more accessible and energy-efficient but may not be as profitable in the long run. Ultimately, the decision between mining and staking for passive income will depend on individual preferences and risk tolerance.

Analyzing the upfront costs and ongoing expenses of mining versus staking

When considering the profitability of mining versus staking in the world of cryptocurrency, it is essential to analyze the upfront costs and ongoing expenses associated with each method.

**Mining** typically requires a significant initial investment in specialized hardware, such as ASIC miners or GPUs, as well as the cost of electricity to power these machines. Additionally, miners may need to factor in expenses for cooling systems to prevent overheating. These upfront costs can be substantial and may take time to recoup through the mining process.

On the other hand, **staking** generally requires less initial investment compared to mining. Stakers need to acquire a certain amount of cryptocurrency to participate in the staking process, but they do not need to purchase expensive hardware or pay for electricity. This makes staking a more cost-effective option for those looking to get involved in cryptocurrency without a large upfront investment.

In terms of ongoing expenses, **mining** continues to incur electricity costs as long as the mining hardware is operational. Additionally, miners may need to budget for maintenance and upgrades to ensure their equipment remains efficient. These ongoing expenses can eat into profits and impact the overall profitability of mining.

**Staking**, on the other hand, has minimal ongoing expenses once the initial investment in cryptocurrency is made. Stakers do not need to worry about electricity costs or hardware maintenance, making it a more predictable and potentially more profitable option in the long run.

In conclusion, when comparing the upfront costs and ongoing expenses of mining versus staking, it is clear that staking is the more cost-effective option for those looking to maximize their profits in the world of cryptocurrency. While mining can be profitable under the right circumstances, the high upfront costs and ongoing expenses make it a less attractive option for many investors.

Exploring the environmental impact of mining versus the energy efficiency of staking

Mining and staking are two popular methods for earning cryptocurrency, each with its own set of advantages and disadvantages. One key consideration when comparing the two is their environmental impact and energy efficiency.

When it comes to mining, the process involves solving complex mathematical problems using powerful computers. This requires a significant amount of electricity, leading to concerns about the environmental impact of mining. The energy consumption of mining operations has raised questions about sustainability and the carbon footprint of the cryptocurrency industry.

On the other hand, staking is often considered a more energy-efficient alternative to mining. Staking involves participating in a proof-of-stake system, where users are chosen to create new blocks and validate transactions based on the number of coins they hold. This process consumes significantly less energy compared to mining, making it a more environmentally friendly option.

It is essential to consider the environmental impact of mining versus the energy efficiency of staking when deciding which method to use for earning cryptocurrency. While mining may offer higher potential profits, staking provides a more sustainable and eco-friendly approach to cryptocurrency earning. Ultimately, the choice between mining and staking depends on individual preferences and priorities, whether it be maximizing profits or minimizing environmental impact.

Examining the potential for scalability and long-term profitability in mining and staking

When examining the potential for scalability and long-term profitability in mining and staking, it is essential to consider various factors that can impact the overall success of each method. Mining involves solving complex mathematical problems to validate transactions and add new blocks to the blockchain, while staking involves holding a certain amount of cryptocurrency in a wallet to support the network and validate transactions.

One key factor to consider when evaluating the scalability of mining and staking is the energy consumption associated with each method. Mining typically requires a significant amount of computational power, which can lead to high energy costs. On the other hand, staking is generally considered to be more energy-efficient, as it does not require the same level of computational power.

In terms of long-term profitability, mining and staking both have their advantages and disadvantages. Mining can be profitable in the short term, especially when the price of the cryptocurrency being mined is high. However, as more miners join the network, the competition increases, making it harder to mine new coins. Staking, on the other hand, can provide a more stable source of income, as it rewards users for holding their coins and supporting the network.

Ultimately, the decision between mining and staking will depend on various factors, including the individual’s risk tolerance, investment goals, and technical expertise. It is essential to carefully consider these factors and conduct thorough research before deciding which method is more suitable for achieving scalability and long-term profitability.

Considering the security implications and decentralization factors of mining and staking

When considering the security implications and decentralization factors of **mining** and **staking**, it is important to weigh the pros and cons of each method. **Mining** typically involves using computational power to solve complex mathematical problems in order to validate transactions on a blockchain. This process requires a significant amount of energy and resources, which can lead to centralization of power among a few large **mining** pools. On the other hand, **staking** involves holding a certain amount of cryptocurrency in a wallet to support the network and validate transactions. This method is generally considered to be more energy-efficient and environmentally friendly compared to **mining**.